ETH Price Prediction: Can Ethereum Reach $8,000 by Year-End?

#ETH

- Technical Breakout: ETH testing upper Bollinger Band with MACD showing reversal potential

- Institutional Demand: Stripe's blockchain move and Thiel's investment signal growing adoption

- Macro Catalysts: FED policy could accelerate ETH's climb toward $8K

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

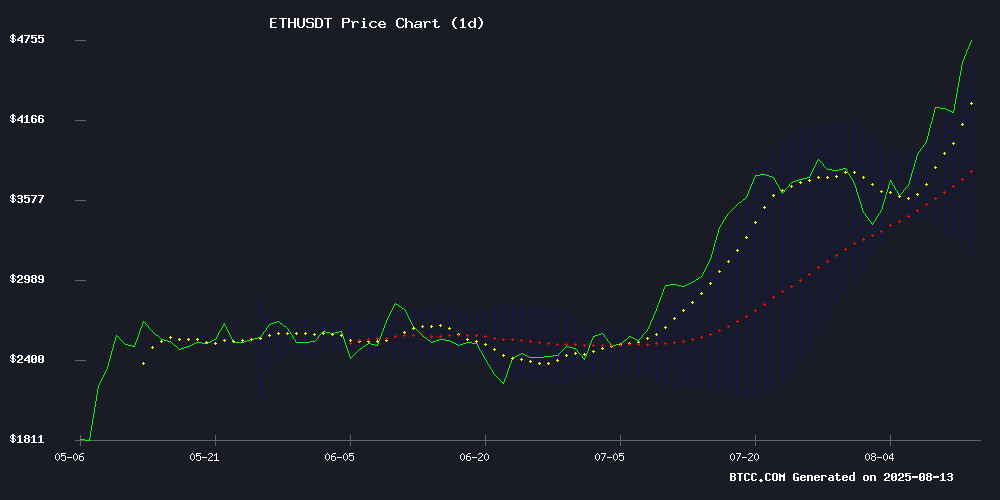

According to BTCC financial analyst James, ethereum (ETH) is currently trading at $4,716.32, significantly above its 20-day moving average (MA) of $3,889.77, indicating strong bullish momentum. The MACD indicator shows a negative value (-150.17), but the histogram is narrowing (-36.49), suggesting potential trend reversal. Bollinger Bands reveal ETH is testing the upper band at $4,580.76, which could act as resistance. A breakout above this level may propel ETH toward new highs.

Market Sentiment Heats Up as Institutional Demand Fuels ETH Rally

BTCC analyst James highlights bullish catalysts for Ethereum, including FED rate cut speculation and institutional adoption. News of Peter Thiel's increased ETH stake and Stripe's blockchain initiative further bolster confidence. However, liquidations exceeding $294M in 24 hours indicate volatility risks. James notes, 'The $6,000 price target seems achievable this month if institutional inflows persist.'

Factors Influencing ETH’s Price

FED Rate Cuts Could Propel Ethereum to $8K by Year-End, Analyst Predicts

Ethereum's price trajectory may see a significant boost from anticipated Federal Reserve policy shifts, with Derive's Head of Research Sean Dawson projecting a potential surge to $8,000 by year-end. The forecast hinges on a 95% probability of 25 basis point rate cuts in September, as indicated by Fedwatch and Polymarket data.

Labor market weaknesses—rising unemployment and downward revisions to job reports—are creating mounting pressure for monetary easing. "The overwhelming driver of ETH's price action this cycle has been institutional accumulation," Dawson noted, pointing to treasury vehicles like Bitmine and Ethermachine now holding 3.6 million ETH (3% of supply), up from negligible amounts in April.

While layer-2 scaling solutions like Dencun contribute to Ethereum's fundamentals, macroeconomic forces appear dominant. Falling rates coupled with expected US fiscal stimulus through the "Big Beaut" initiative could create ideal conditions for ETH's ascent.

SharpLink Gaming Shares Drop 6.6% Amid $400M Ethereum Treasury Expansion

SharpLink Gaming (NASDAQ: SBET) saw its shares decline 6.6% to $22.34 after announcing a $400 million share purchase agreement to bolster its Ethereum reserves. The sports betting firm, now positioning itself as an Ethereum treasury company, disclosed the deal involves five institutional investors and is set to close imminently.

With 598,800 ETH ($2.57B) already held, SharpLink ranks as the second-largest public Ethereum holder behind BitMine Immersion Technologies. Ethereum co-founder Joseph Lubin's role as chairman underscores the strategic pivot. The stock partially recovered 3.5% in after-hours trading following a 17.5% rally earlier in the week.

Ethereum Surpasses Netflix in Market Capitalization

Ethereum's market capitalization has surged to approximately $566 billion, briefly eclipsing the valuations of Netflix and Mastercard. This milestone positions Ethereum as the 22nd largest global asset, underscoring its escalating prominence in the digital economy.

The blockchain platform's growth is driven by accelerating adoption in decentralized finance, non-fungible tokens, and Layer 2 scaling solutions. Institutional interest continues to mount as network activity reaches new highs, solidifying Ethereum's status among the world's most valuable assets.

Traders are monitoring Ethereum's trajectory closely as it cements its position in the upper echelons of global market capitalization rankings. The asset's performance reflects broader confidence in blockchain infrastructure's transformative potential across financial markets.

ETH Liquidations Hit $296.55M in 24 Hours

Ethereum traders faced $296.55 million in liquidations over the past day as volatility rocked the market. Forced closures of leveraged positions accelerated across exchanges amid sharp price swings.

Bearish bets bore the brunt of the damage. Rising ETH prices compounded losses for short sellers, underscoring the perils of excessive leverage during turbulent conditions. The scale of liquidations reflects heightened speculative activity in the derivatives market.

Stripe Appoints Paradigm's Matt Huang to Lead New Blockchain Tempo

Stripe has named Matt Huang, co-founder of crypto venture firm Paradigm, as CEO of its upcoming blockchain project Tempo. Huang retains his role at Paradigm while taking the helm of Stripe's payments-focused Layer 1 chain, which will maintain Ethereum compatibility.

The move signals growing institutional interest in stablecoin infrastructure. Tempo joins a competitive landscape including Plasma's $373 million token sale and Tether's Stable chain. The sector's $270 billion market cap recently gained regulatory clarity through the U.S. GENIUS Act.

Huang brings deep crypto expertise from Paradigm's $12.7 billion portfolio, including Uniswap and Fireblocks. His dual role underscores the convergence between traditional finance and blockchain innovation.

Peter Thiel's ETHZilla Stake Sparks 207% Rally as Tech Billionaire Doubles Down on Ethereum

Peter Thiel's venture capital arm has acquired a 7.5% position in ETHZilla, sending shares of the Ethereum-focused treasury firm soaring 207% in a single session. The Palantir co-founder now holds stakes in two crypto asset managers after last month's investment in BitMine Immersion Technologies.

ETHZilla's transformation from biotech research to ETH treasury management appears validated by Thiel's vote of confidence. The company currently custodies 82,186 ETH ($349M) alongside $238M in liquid assets, employing Electric Capital's staking infrastructure to generate shareholder yields.

Market reaction was immediate and violent - shares catapulted from $3.34 to $10.24 on the Nasdaq, demonstrating institutional capital's growing appetite for crypto-native yield strategies. Thiel's parallel 9.1% stake in BitMine suggests a calculated accumulation of exposure to Ethereum's staking economy.

Ethereum Liquidations Top $294 Million As ETH Approaches New All-Time High

Ethereum surged to within 4% of its all-time high Wednesday morning, triggering nearly $300 million in liquidations. The rally punished short sellers, with over $250 million in ETH short positions liquidated—accounting for nearly half of all crypto market liquidations.

The token reached $4,700 for the first time since late 2021, continuing a relentless climb that began in August. At press time, ETH traded at $4,694, up 7.9% on the day and 52.7% over the past month.

Derivatives markets bore the brunt of the move. ETH dominated liquidation activity, dwarfing Bitcoin's $41.5 million in liquidations during the same period. Long positions weren't spared either, with $44 million in bullish bets getting wiped out.

Institutional Buying Drives ETH Price Rally—Ethereum to Hit $6000 This Month

Ethereum is experiencing a surge in institutional demand, with large-scale inflows propelling the asset toward critical resistance levels. The heightened activity suggests bullish momentum could push ETH to test $6,000 this month—a threshold not seen in months.

Whales and ETFs are aggressively accumulating ETH, reducing circulating supply and amplifying upward price pressure. Network growth and adoption metrics further reinforce the bullish case, with technical levels serving as key indicators for trend sustainability.

How High Will ETH Price Go?

Based on technicals and market sentiment, BTCC's James projects these key ETH price levels:

| Scenario | Price Target | Timeframe |

|---|---|---|

| Bullish Breakout | $6,000 | August 2025 |

| Fed Rate Cut Rally | $8,000 | December 2025 |

| Bearish Rejection | $3,900 (MA Support) | Near-term |

Note: Prices may fluctuate due to macroeconomic factors and network congestion risks.